montgomery al sales tax form

Johnson is an American multinational privately held manufacturer of household cleaning supplies and other consumer chemicals based in Racine Wisconsin. Winners will be recognized at theApril 24 2022 Awards and Reflections Virtual Program.

Act 98-192 known as the Local Tax Simplification Act of 1998 required each county and municipality to submit to the Department a list of any sales use rental lodgings tobacco or gasoline taxes it levied or administered and the current rates thereof.

. Tax Type Authority Sales Tax Title 40 Chapter 23 Article 1 Use Tax Title 40 Chapter 23 Article 2 Simplified Sellers Use Tax Title 40 Chapter 23 Article 6 Div 3 Part 2 Leasing Tax Title 40. 74494 Median gross rent in 2019. Montgomery Alabama detailed profile.

Townhouses or other attached units. Use Tax Filing If you make a tax-free purchase out of state and need to pay Marylands 6 percent use tax file the Consumer Use Tax Return with your payment by the appropriate due date. Please see form for instructions.

The company is owned by the Johnson family. Alabama State Income Taxes for Tax Year 2021 January 1 - Dec. Along with Louisiana they utilize this 3rd party service to collect and maintain all sales taxes for the state.

March 2019 cost of living index in Montgomery. See Form ST-101-I Instructions for Form ST-101 page 5. Emergency Rental Assistance Montgomery County ERAMCo is here to help.

March 15 2022 at 000 AM. Professional Licensing Some services such as beauty shops photographers restaurants diaper services fruit stands contractors and others require professional licensing in Alabama. Box 2401 Montgomery AL 36140-0001.

The primary duty of the Attorney General is to serve as legal counsel to Alabamas state agencies departments and officers. AL 35209 205 322-6666. Not available with special finance or lease offers.

Nancy Bucklew as Personal Representative for the Estate of Steven P. Awards-1st Place 75-2nd Place 50-3rd Place 25. Must show proof of a current ownership or lease of a 2008 model year or newer Buick or GMC Passenger.

Alabama LLC entity search s corporation search c corporation search corporation entity search business name search company name lookup name search business EIN business name availability agent of record incorporation date corporate officers legal. Mean prices in 2019. First Citizens Bank Trust Company vs.

Payments are for a 2022 CHEVROLET Camaro Coupe LT1 w10-speed automatic with an MSRP of 36790. 39 monthly payments total 8931. 2022 GMC Sierra 1500 Limited Crew Cab AT4.

Review the laws on the Alabama Legislatures web site. Severe Weather Sales Tax Holiday starts Friday. Sales Tax Permit Businesses selling products and certain services will need to register for a Sales Use Tax Permit with the Alabama Department of Revenue.

The sales tax is remitted on a sales and use tax return. Accounting for Income Taxes. Johnson employed approximately 13000 people and had estimated sales of 10 billion.

For Current Lessees of 2017 model year or newer non-GM vehicles. To file by mail send your relevant tax forms to the Alabama Department of Revenue at one of these addresses depending on which form you file and whether you include a tax payment. COVID-19 has affected residents across the state.

Tax law is complex and constantly changing but you can trust that Warren Averetts accountants in Birmingham AL are committed to staying up to date on the tax code and the tax strategies that can best benefit our clients. Form 40 without payment. 2569 South Washington Street Manilla IN 46150 Date.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Your payments may vary. Dont forget to sign your check 00-0000000 ST-101 FY 2021 March 10 2021 XXXXXXNew York State Sales Tax your payment amount Need help.

80000211210094 Page 2 of 4 ST-810 1121 0922 Quarterly Sales tax identification number New York State only NE 0021 00 00 4 Albany County AL. Whether you have excellent credit and are looking for the best loan rate possible or your credit is less than stellar we can get you into a new or used vehicle at a. We have emergency funds available to help Montgomery County residents pay rent and utility bills including past due rent and utilities.

Theres often no way to know if a sales tax license is required only at the state level. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a AL state returnThe Alabama tax filing and tax payment deadline is April 18 2022Find IRS or Federal Tax Return deadline details. March 16 2022 at 100 PM.

Johnson Son Inc. Steve Garst was born in Montgomery but spent his growing up years in Mobile. Lakeview Loan Servicing LLC vs Kyle Wayne Callahan Address.

There are no state tax credits for solar power in Alabama but the 30 federal tax credit is already a great benefit on its own accord. Each dealer sets own price. Sales tax identification number A21 7A Vendor collection credit worksheet 7B Dont forget to write your sales tax ID number ST-101 and FY 2021.

Montgomery County Property Records are real estate documents that contain information related to real property in Montgomery County Alabama. Liens are sold at auctions that sometimes involve bidding wars. Today the couple call Elmore County home which leads us to their Doghouse which has nothing to do with doghouses.

Box 154 Montgomery AL 36135-0001. A tax lien is a claim the government makes on a property when the owner fails to pay the property taxes. At issue with sales tax registrations is the fact that many counties and local governments in Alabama rely on Revenue Discovery Systems RDS.

Take new retail delivery by 02-28-2022. Unlike many other dealerships in nearby Opelika Montgomery Columbus and AUBURN AL here at Lynch Chevrolet-Cadillac of Auburn were committed to flexible Chevrolet financing. Our office is prohibited by law from providing private citizens with legal advice representation or opinions.

On a 20000 solar PV system this means getting back 6000 as tax deductions within one year and if you are not taxed that high you can split the benefit and apply it over two. Commonly referred to as S. Bucklew Nancy Bucklew Midland Funding LLC Address.

His wife Deb is a Birmingham native. Our tax professionals are versed in local state federal and international tax including. Form 40 with payment.

Alabama Sales Tax Bond Jet Insurance Company

2001 Form Al St Ex A2 Fill Online Printable Fillable Blank Pdffiller

710 The Cliffs Ct Waterfront Homes Outdoor Decor Patio

Sponsorship Agreement Example Best Of Sponsorship Agreement Within Sports Sponsorship Agreement Templ Sponsorship Letter Sponsorship Proposal Contract Template

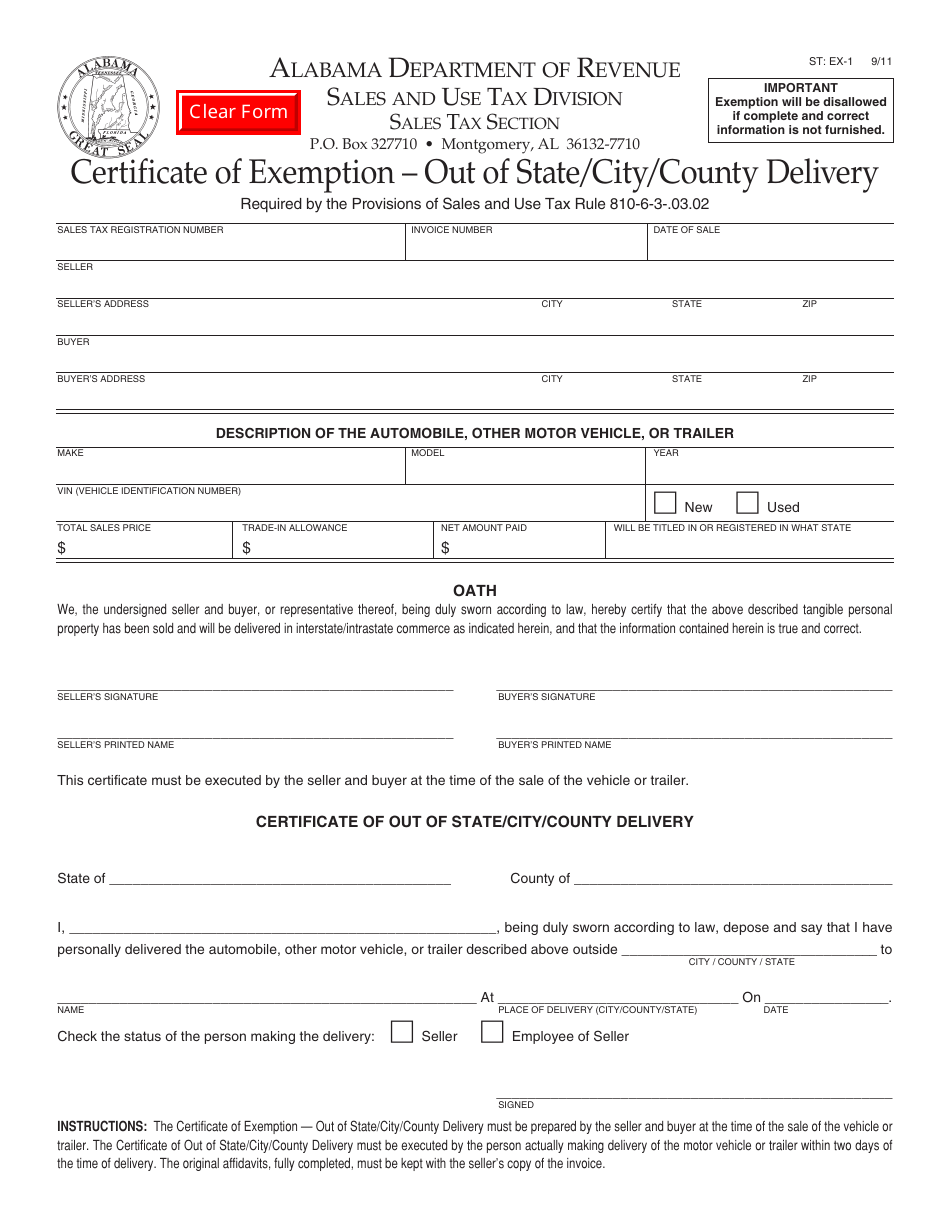

Form St Ex 1 Download Fillable Pdf Or Fill Online Certificate Of Exemption Out Of State City County Delivery Alabama Templateroller

Alabama 9501 Fill Online Printable Fillable Blank Pdffiller

Bmx Plus 101 Freestyle Tricks Vhs Advertisement Circa 1986 87 Bmx Flatland Old Scool Bmx Freestyle

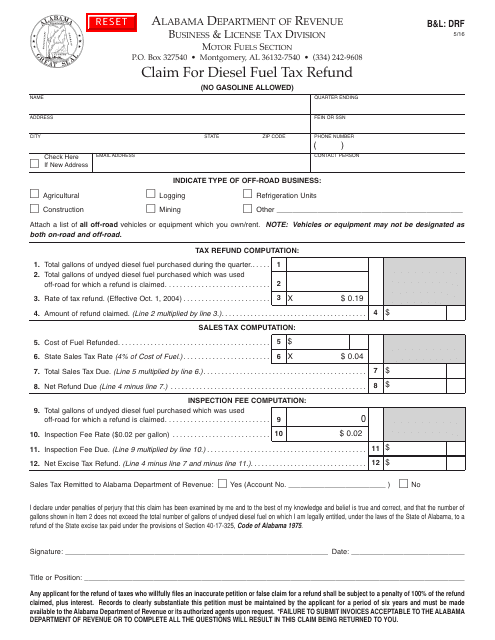

Form B L Drf Download Fillable Pdf Or Fill Online Claim For Diesel Fuel Tax Refund Alabama Templateroller

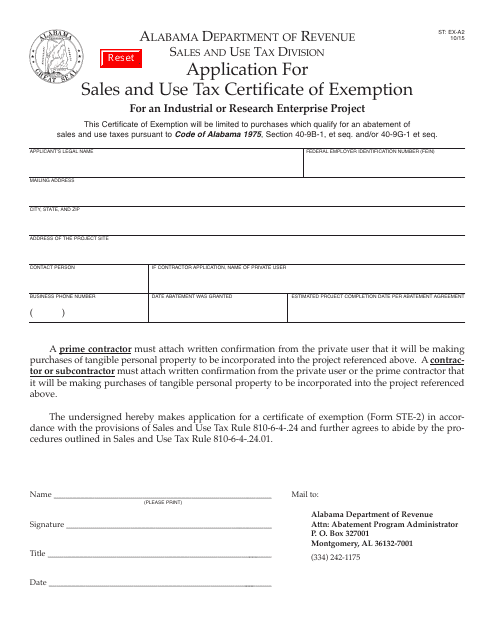

Form St Ex A2 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project Alabama Templateroller

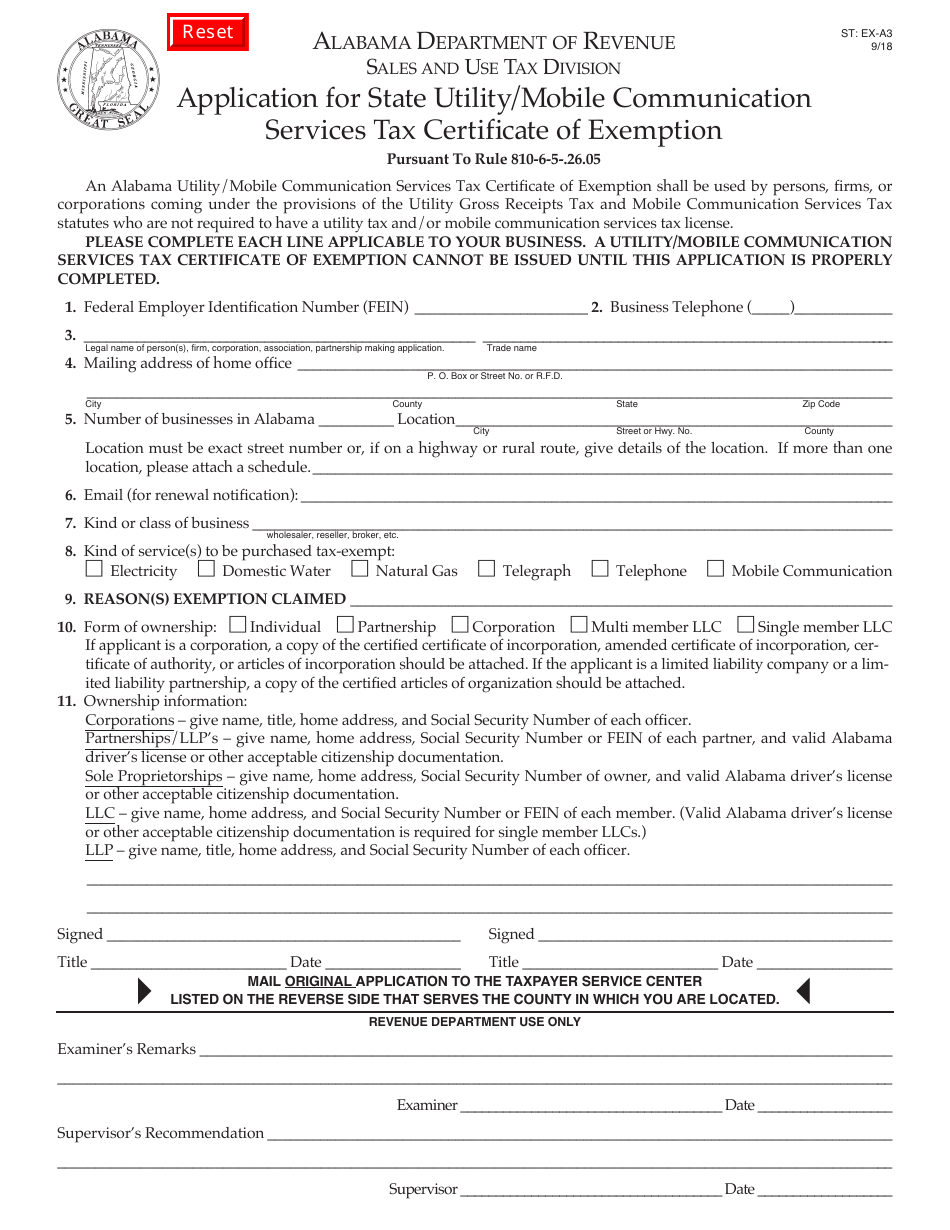

Form St Ex A3 Download Fillable Pdf Or Fill Online Application For State Utility Mobile Communication Services Tax Certificate Of Exemption Alabama Templateroller

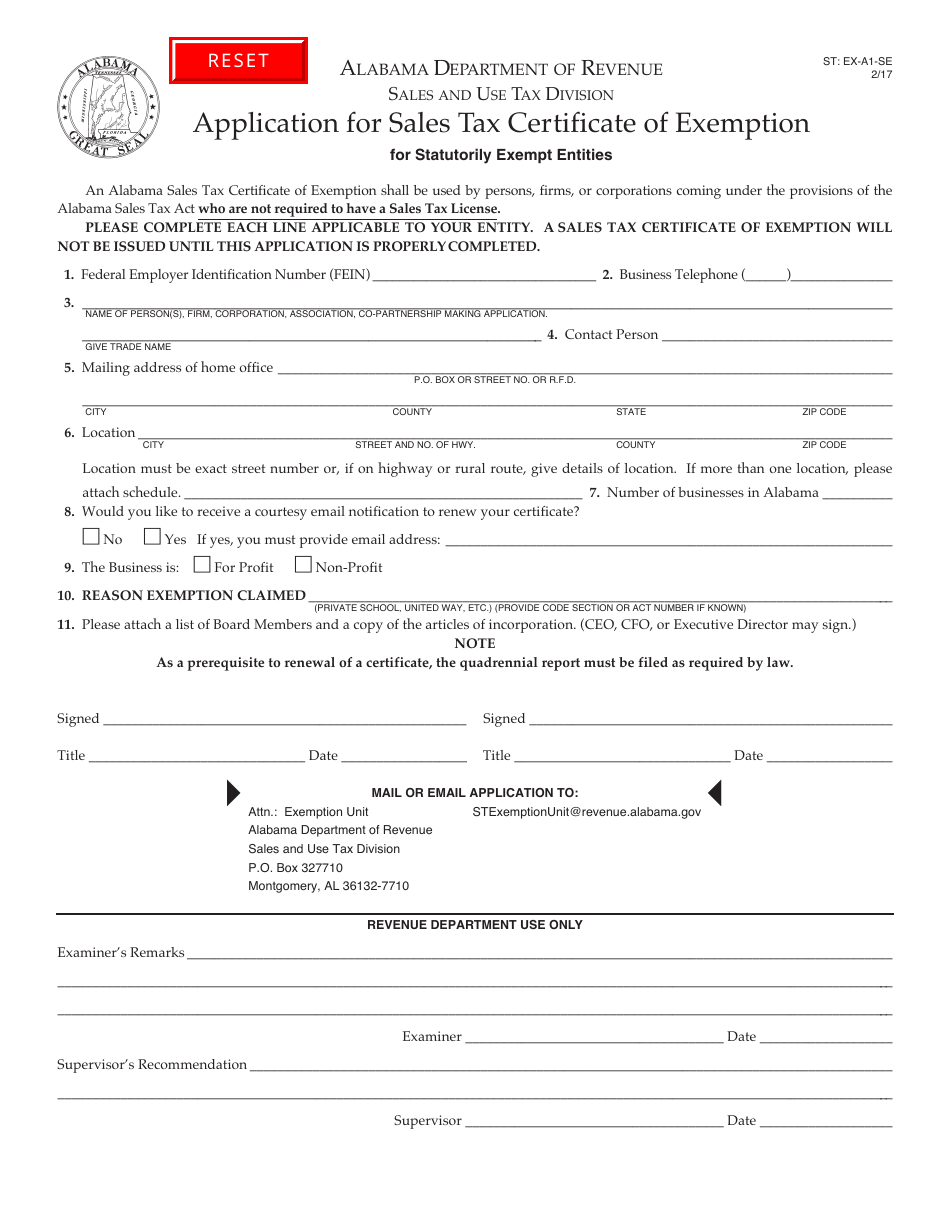

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller